Easy, 20 Minute, 7 Action Steps To Start Long-Term Investing Toward Financial Independence

20-minute simple action steps to start long-term investing. It'll change your life, your kids' future.

We’ve all heard “Don’t work for money. Make money work for you”, or “Invest early”. But what does it mean? How do I do it?

Well, for the average investor like you and me, investing is not about picking stocks. This is not a secret. It has been well taught, well written. It takes discipline and less than half an hour to do.

Below are my key takeaways on long-term investing from “The Barefoot Investor” book by Scott Pape, “I will teach you to be rich” book by Ramit Sethi (12 hour book), “Money. Master the Game” book by Tony Robbins (18 hour book), plus hours of reading and online research. The books are about the same long-term investing and primarily for US citizens (except Scott Pape’s). I’ve done my research to find Australian equivalent versions. You can find equivalent methods where you live.

Understanding the power of compounding interest

Compounding interest is the interest calculated on the principal and the interest accumulated over the previous period.

For example:

You invest $100 (the principal) then you forget about it. The interest is 10%

The 1st year: you’ll have $100 + 10% = $100 + $10 = $110

The 2nd year: you’ll have $110 + 10% = $110 + $11 = $121 (doesn’t so much right?)

Guess how much you’ll have after 30 years?

https://moneysmart.gov.au/budgeting/compound-interest-calculator

You’ll have $1,745 after 30 years! And you’ve done nothing!

This is “Make money work for you” instead of working for money.

Now, we just need to find a place to invest our money to earn this 10% compounding interest annually.

Hint: the stock market has returned 9.9% annually on average over the past 30 years. We just need to know where to invest.

https://www.fool.com/investing/how-to-invest/stocks/average-stock-market-return/

Easy Action Steps for long-term investing toward Financial Independence (FI)

For everyday people like you and me, do not try to pick what stocks to buy.

Simply follow one of these 2 methods to start investing for the long term:

Method 1

The simplest and easiest method. Set-and-forget investing.

Open a personal investor account with Stake, Pearler, or Vanguard so that you can start investing (5 minutes).

Invest a set amount of money consistently every month in pre-made low-cost index funds / ETFs such as S&P 500 Index Fund (ticker IVV in Australia or VOO in the US), or Vanguard Diversified High Growth Index ETF (ticker VDHG). Recommended to set up Auto Invest (set and forget) if you use Pearler.

Invest and hold: Let your money grow by compounding over 20-30+ years (the Return).

Or

Method 2

Open an account with Pearler.com so that you can start investing (5 minutes).

Pick a Portfolio that suits your age and risk profile.

Use dollar cost averaging to invest a set amount of money consistently every month into low-cost Index Funds / ETFs (this can be automated with Pearler).

Rebalance your portfolio once a year.

Invest and hold: Let your money grow by compounding over 20-30+ years (the Return).

You’ve finished!

Optional - Optimize your Super (retirement saving account, also known as IRA in the US): open a super account with HostPlus or Vanguard Australia. Pick the lowest-cost investment option such as HostPlus’s Indexed Balance investment or Vanguard’s Lifecycle investment (10 minutes).

Why invest and hold for 20-30+ years?

Because the market will go up/down in the short term, no one knows when it’ll go up or down. However, the market has been consistently returning on average about 7% to 10% annually over 20-30+ years.

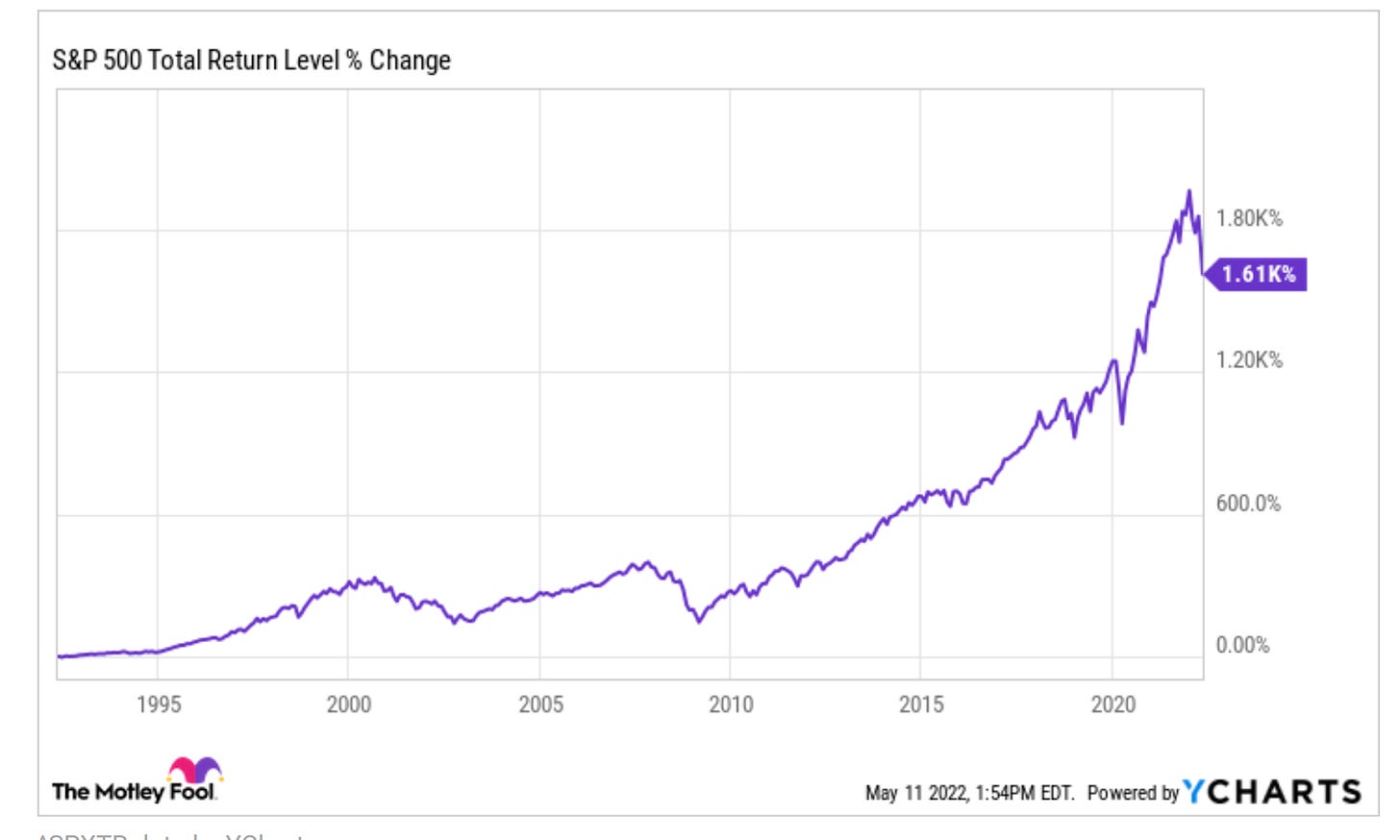

US stock market performance (return per annum) in the past 30 years:

The US S&P 500 annual returns over the past 30 years were 10.7% p.a.:

Below is a sample of investing only $200 /week over 30 years with an annual return of 7%.

https://moneysmart.gov.au/budgeting/compound-interest-calculator

Open an account for you and your kids Now. You’ll know their future is secured so that you can focus on your work/business.

After putting money into your long-term investments, if you still have leftover money, you can:

Spend the money with no guilt, or

Invest the money in other things (real estate, or risky investments such as individual stock).

Setting your goal and then working backward

Say, your goal is to have $2m at the age of 65.

So now you know you’ll need to invest $410/week for 30 years.

Then optimize your earning and spending

Find innovative ways of earning more

Carefully spend only on the things that you really need (and on things that you love and that bring you great joy and value)

When you reach your Financial Independence (FI) number or passive income threshold, voila!

Understanding Financial Terms

Confused? Below is explanation of financial terms in plain English.

Investor

The Investor is You.

Stock = Share = Equity

When you buy a stock of a company, you own a piece of that company (equity). Investing in stock usually comes with higher risk. If the company does well in the stock market (e.g. it makes lots of money), your stock value increases. If the company does badly, your stock loses value or you may lose it all.

Bond

Bonds are backed by a corporation or a government. Investing in government bonds is considered safe but the return is lower than stocks. The only chance your government bond is lost is when the government defaults on its debt. This is rare because the government will simply print more money.

Security

In finance, a security is a tradable financial item such as a stock, or a bond.

Return (or Return on Investment - ROI)

Is how much you get back from your investment. Say you invest $10 in a stock, and it returns 7%, it means you’ll receive $10 + $0.7 = $10.7

Return can be negative such as -10%

Portfolio

Your portfolio is what investments you have. For example, your $100 portfolio contains 70% stock ($70) and 30% bond ($30).

Warren Buffett’s recommended portfolio for the average investor: 90% in S&P 500 stocks, 10% in short-term government bonds.

A Broker

A broker is not a person. It’s a website (like eBay) where you sign up to trade stock / ETFs.

Examples of brokers:

Pearler: recommended for long-term investing (I’ll use this) - Recommended. Good for long-term investing.

Vanguard: is a broker and a fund manager with both low-cost mutual funds and low-cost index funds. Recommended. Vanguard is well known to be investor friendly because they are “not for profit”. Vanguard is owned by their clients - the investors (You).

Stake: recommended if you’re an active trader.

Interactive Brokers: cheap to trade US stock, more expensive to trade Australia’s stock.

Opening an account with these brokers is all done online and takes less than 5 minutes. They’ll require your photo ID, TFN (Tax File Number), and ACN/ABN (for company account only).

If your Broker goes bankrupt, your money is safe as long as the Broker is CHESS-sponsored (in Australia).

Diversify / Diversification

If you put all of your money into 1 stock, you’ll have the chance to win big, or you may lose it all.

Thus, you need to diversify by putting money into different securities such as combinations of different stocks and bonds.

If a security performs badly, the others may perform well and balance it out.

Fund

A fund is a basket of securities. A fund may contain 100s, or 1000s of securities.

For example, the S&P 500 Index Fund consists of stocks of the largest 500 US companies. Thus, when you buy an S&P 500 fund, you’ll automatically diversify your investment because you’re buying stocks of 500 largest US companies in one purchase.

Managed Fund = Mutual Fund (Actively Managed Fund) - This is the bad one (AVOID)

In Australia, it’s called a Managed Fund. In the US, it’s called a Mutual Fund. They are actively managed funds because the fund requires lots of human labour to manage. These are usually more expensive due to higher fees (~1% in fees, more on this below) to pay for the people who manage the fund. The fund managers work to try to beat the market in order to return more to their investors.

Generally, you should avoid investing in actively Managed/Mututal Fund due to their high management fees. Over 96% of mutual funds fail to beat the market to make higher returns to investors over the long run. And their fees take up a chunk of your money. There are many low-fee Managed/Mutual Funds now because of competition. But you should take precautions.

Index

You can think of an Index as something that represents (tracks) a market, or a sub-market.

For example:

The S&P 500 tracks the performance of the 500 largest US companies (Apple, Google, Amazon, Tesla etc)

The S&P 300 ASX tracks the performance of the 300 largest Australian companies.

There are indexes for small-cap companies, large-cap companies, precious metals, oil, etc. If a market or sub-market goes up or down, the Index will correspondingly go up or down.

You cannot buy an Index.

Index Fund (Passively Managed Fund)

Important

LOW-COST Index Funds are what you should invest in

An Index Fund is a fund that tracks an Index such as the S&P 500 Index. An Index Fund is also known as a passively managed fund. It requires little to no human labour to manage thus it has much lower fees. Index Funds do not try to beat the market, they simply try to match the market (using computers).

Because you cannot buy an Index, so Index Fund was created so that you can buy (invest) Index Funds.

Many books and legendary investors such as Warren Buffet have recommended that the average person should invest in low-cost Index Funds.

To invest in a low-cost Index Fund, open an account with a broker such as Pearler / Vanguard.

Vanguard, Schwab, Fidelity are known for low-cost funds because they are “not for profit” / investor-friendly. Vanguard is available in Australia.

Index Funds automatically diversify your investment. Index creators select top-performing companies in the market the Index tracks. For example, the S&P 500 Index tracks the largest 500 companies in the US, thus when you buy an S&P 500 Index Fund, you’re buying a piece of all those 500 US companies in one single purchase. If a company performs badly, it’s dropped from the Index and replaced by a better one. The Index creator does this so you don’t have to.

And, it’s not expensive to buy an Index Fund.

ETF (Exchange-Traded Fund)

Important

Most ETFs are Index Funds. An ETF is very similar to an Index Fund. Many ETFs are low-cost (make sure to compare costs).

Their cost is also called Management Expense Ratio (MER).

ETFs can be purchased on the stock market directly and easily via a Broker like you’d bid / buy on eBay.

Fund Management Fees

Important

A fund’s fees vary depending on the company that provides the fund and varies between countries.

How much is expensive or low-cost (a Fund’s management fees or MER)?

Under 0.05% - 0.08% is extremely low (very good)

Under 0.2% - 0.3% is in the low range (good)

0.5% is likely the medium range (to evaluate and consider)

0.8-1% or higher is considered expensive and must be avoided.

Also, pay attention to Buy/Sell spread cost. Whenever you buy/sell a fund, you’ll pay these fees. These fees are on top of MER.

Many Managed/Mutual Funds have Buy/Sell spread costs.

Many ETFs / Index Funds have 0 (ZERO!) Buy/Sell spread costs.

In Australia, MERs are generally more expensive than in the US.

For example:

Vanguard’s S&P 500 ETF (ticker VOO, only available in the US) has an expense ratio of 0.03% which is extremely low.

https://investor.vanguard.com/investment-products/etfs/profile/voo

iShares’s S&P 500 ETF in Australia has an expense ratio of 0.04% which is also extremely low.

https://www.blackrock.com/au/individual/products/275304/ishares-s-p-500-etf

Ticker / Symbol

Is a unique symbol that represents a stock or ETF on the stock market so that when you search to buy this ticker, you know which stock / ETF you’re buying.

For example, Apple’s stock is AAPL.

Target Date Fund = Target Retirement Fund = Lifestage Fund = Lifecycle Fund

They’re the same. In Australia, it’s called Lifecycle fund

Roth IRA in the US is equivalent to Superannuation (Super) in Australia

Roth IRA is only in the US: Retirement investment account with tax efficiency (lower tax or no tax)

In Australia, the equivalent is Super.

What your Portfolio should look like

Important

There is no one perfect portfolio. It depends on you.

Below is what legendary investors recommended for the average investor:

Warren Buffett recommended a 90/10 portfolio: 90% in US stocks (S&P 500 Index Fund particularly), 10% in short-term government bonds. And hold it for 20+ years (recommended 30-40+ years).

Ray Dalio showed an “All weather portfolio”: 30% in stock, 55% bond, 15% commodities. He didn’t recommend this but this is a portfolio that he created that will go through all market storms with the lowest risk and still generate a decent return.

If you’re young: in 20s, 30s or 40s, and you’re willing to take risks for higher returns. You may prefer a high-growth portfolio such as:

90/10: 90% in stock, 10% in bond

100: 100% in stock

If you’re young and have a family and you’re not so “risky”, your portfolio may look like this:

70/30: 70% in stock, 30% in bond

60/40: 60% in stock, 40% in bond

If you’re in your 50s, 60s+, or you’re not risky, your portfolio may look like:

Ray Dalio’s All weather portfolio

50/50: 50% in stock, 50% in bond

The key is to regularly invest and hold it for 20-30+ years without withdrawing money (long-term investment).

Dollar cost averaging

Is investing an equal amount of money at regular intervals (e.g. monthly) regardless of stock price. It helps reduce the overall impact of price volatility and lower the average cost per share.

https://www.fool.com/terms/d/dollar-cost-averaging/

Rebalance your portfolio

Rebalancing your portfolio means, once a year, you need to allocate money to keep your portfolio ratio the same as intended.

For example:

Your $100 portfolio is 70/30:

70% in stocks: $70

30% in bonds: $30

After 1 year, stocks performed well and rose by 20% and became $84, while bonds grew slowly by 3% and became $30.9

Your portfolio is now:

Total $114.9

Stocks: $84 which is 73%

Bonds: $30.9 which is 27%

Thus, you need to rebalance it back to 70/30 by:

Reducing the amount of money that you’ll invest in stocks, increasing the amount of money that you’ll invest in bonds (recommended) or

Sell some of the stocks and put them into bonds. Avoid this if possible because it takes more time and incurs some trading fees.

But, stocks are growing, should I invest even more in stocks?

Remember, stocks are volatile. It may go down next year. Eg, it may go down by 30% (-$25.2) and become $58.8 instead.

Thus, you need to keep what you’ve earned by putting more into bonds which are often safer.

But, I don’t mind losing $25.2, I’m willing to take the risk.

How about 30% of $1,000,000 … $300,000?

When you see you’ve lost $300,000 over 2 weeks, you’ll shit yourself and react on emotion - sell early instead of holding it until the storm is over and the market recovers.